High yield municipal bond default rate full#

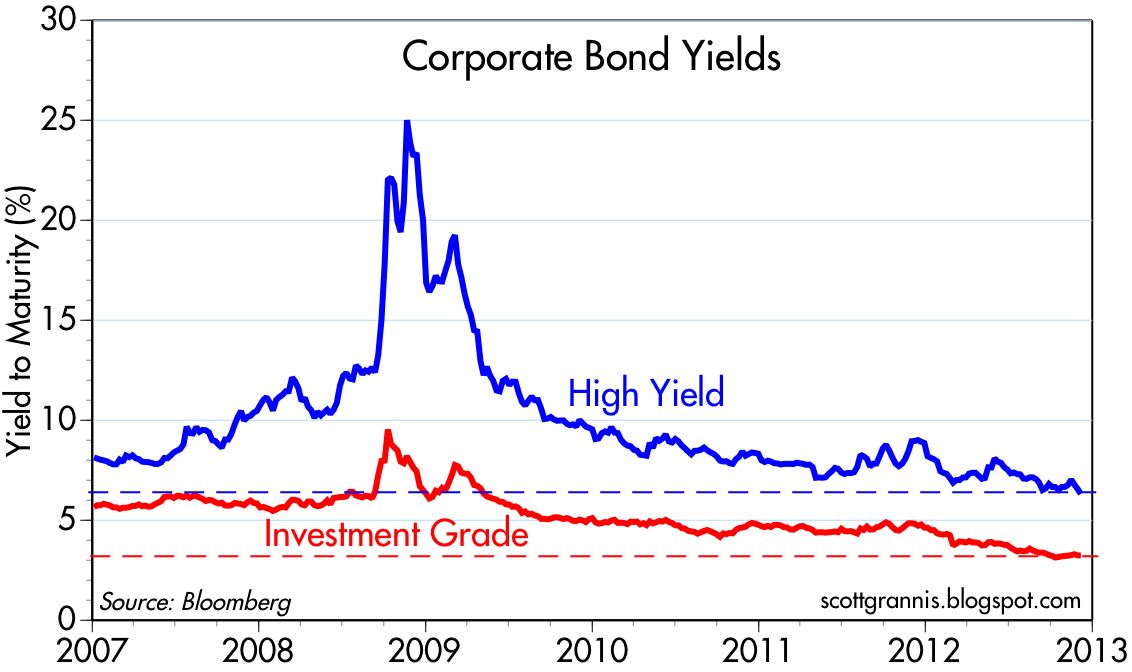

(State general obligation bond = The respective state guarantees the repayment of the bonds backed by its full faith and credit.) We compute a simple average of all trades for a given maturity year for each state. The bonds that we count are state GOs that are non-callable and non-taxable. High yield municipal bonds experienced defaults at rates significantly lower than similarly-rated corporate bonds. 10 year AAA muni yield is close to its high for the year - just like Treasuries, and we believe the.

Taxable municipal bonds generally trade with a higher gross yield than their tax-exempt. Municipal Bond Investor Weekly High Net Worth Wealth Solutions and Market Strategies // Fixed Income Solutions. But they aren’t sure where to buy them and often end up using exchange. Historically, this has meant that default rates have been low. Most high bracket investors love the idea of tax-free muni bonds. By purchasing municipal bonds, you are in effect lending money to the bond issuer in exchange for a. The following is a yield grid with the average yields for state general obligation bonds that traded during the past 5 trading days. Default rates regularly run a lean 0.1 to 0.2. Municipal bonds (or munis for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations and to finance capital projects such as building schools, highways or sewer systems.

0 kommentar(er)

0 kommentar(er)